Real Estate Investment Trust (“REIT”) is a type of “trust” where a trustee is determined its true owner on behalf of its beneficiary and does not have a juristic person status. The trust settlor will eventually become the REIT Manager (RM) whom will offer trust units to the public. Once received capital from the sale of trust units, the RM will entrusted the following fund with the REIT’s designated trustee in order to establish the REIT. The trust deed will assign the REIT Manager to manage the REIT and the trustee to supervise the performance of the REIT Manager and administer the REIT in the best interest of the beneficiary. (source: https://classic.set.or.th/en/products/listing2/set_pfundreits_p1.html)

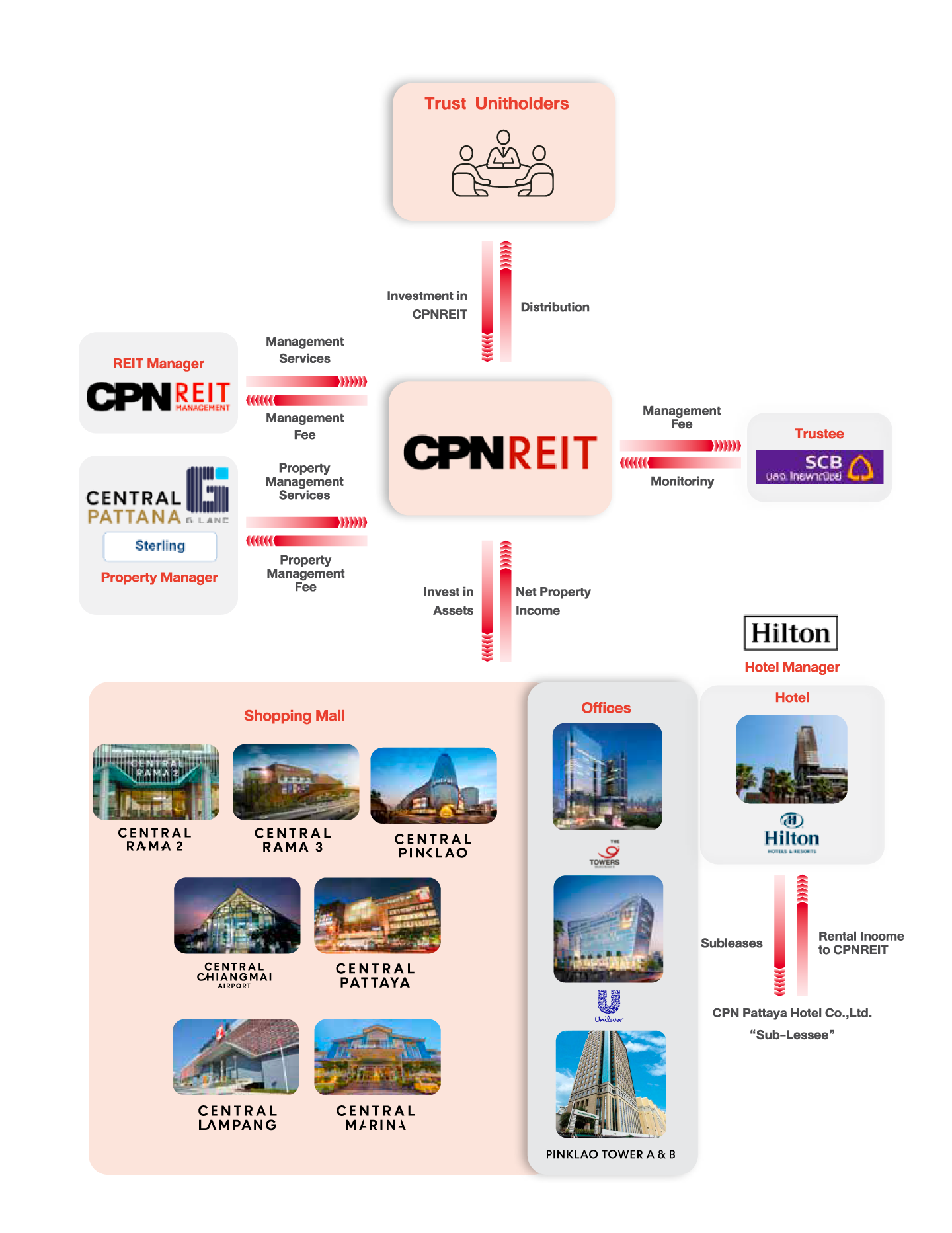

CPNREIT has SCB Asset Management Co., Ltd. as a trustee and CPNREIT Management Co., Ltd. as the REIT Manger, wherein the REIT manager enters into a contract to appoint and hire Property Manager or enters into a contract to appoint and hire Property Manager to perform the duties of managing the property to provide benefits from existing invested assets and additional investment assets.

The REIT Manager, the Property Managers namely 1) Central Pattana Plc. 2) Grand Canal Land Plc. or GLAND 3) Sterling Equity Co., Ltd. or "Stirling", and the sub-lessee namely CPN Pattaya Hotel Co., Ltd., are related parties, with Central Pattana holding 99.99% of the shares in the REIT Manager and Central Pattana Group holding 99.99% of the shares in CPN Pattaya Hotel Co., Ltd. In addition, Central Pattana Group holds 67.53% of the shares in GLAND, with GLAND holding 99.99% of the shares in Sterling.